How to find Market TOP?

5 distribution days happened in 3 week period. . Market closes lower on heavier volume than previous day. Market means SP500 and Nasdaq.

How to find Market Bottom?

2 events leads to it.

After market trades down it starts to go up. That low point is considered as market bottom. After market bottom we have to see Follow Trough days on 4th day or later. But before 10th day.

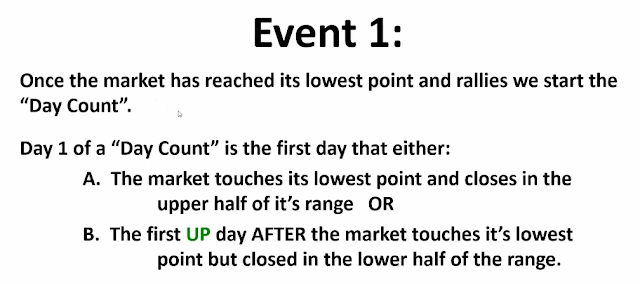

Event 1:

Day 1 of the 'day count' is the first day that either: market touches its lowest point and closes upper half of its range. OR the 1st 'up' day after market touches its lowest point and closes lower half of its range.

Event 2:

Once day 1 occurs and the low is in place we are looking something called as "Follow-Through" day

Follow-Through day

When 1 of the indexes (DJIA, COMP or SP500) closes up 1.25%+ on higher volume than previous day

It happens somewhere on day 4 or later (It does not count if it happens on day 2 or 3 )

The most powerful Follow Through can happen after day 10 but they are rare and usually not as powerful.

This methodology signals the market bottom about 80% of the time and the market has never bottomed without a Follow Through day.

Follow-Through days that have staying power tend to have a lot of stocks ready to lead the charge and ready to breakout. This was not the case initially, but now many more stocks are setting up and breaking out.

If one of the indexes suffers a distribution day (a decline in higher volume) soon after the follow through, its often a sign that the follow through will fail.

Follow through days tend to fail more often after the indexes have fallen sharply over a short period of time while slicing their 50 day and /or 200 day moving averages (like in Feb 2020)

A close below the low of the follow through day also signals likely failure.

|

| Market Top |

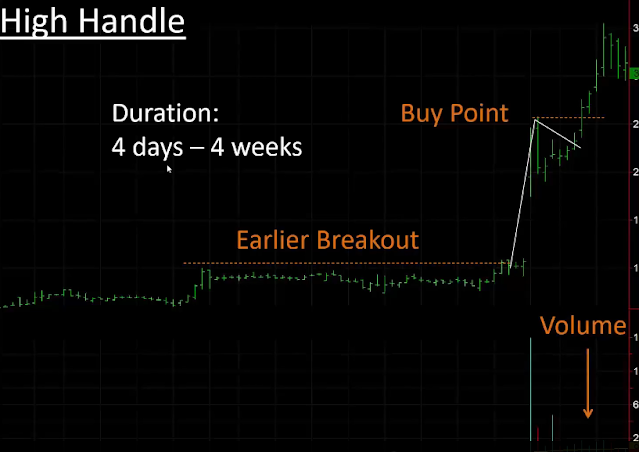

Swing trade.

- 6% protective stop from buy price.

- if Daily RSI close above 86 sell next day.

- No matter what sell on 7th day if any of the above conditions don't met.