12/11/19

If you don't test it Don't trade it.

Many strategies are vague and subject to interpretation in order to make them difficult to impossible test

don't victim of that trap.

ex copper ( RIO, COPX, BHP, FCX, SCCO )

Knoxville Divergence

He used

Momentum Indicator and relative strength index (RSI)

if price goes down but momentum goes up that creates divergence.

MEM research - Mary Ellen McGonagle

How to increase returns using Growth and Income

Key ways to uncover top candidates

- Industry group of stock is outperforming markets.

- Growth prospects are promising.

- Stocks has sound reason for doing well.

- Institutions are involved in stock.

- Economic backdrop supports a continued moved higher.

How to pinpoint Entry and Exit points.

- Stock pulls back to key MA. (High moving stock pulls back to key MA) - Entry

- Volume then picks up as it moves away from MAV - Entry

- Stock breaks out of or forms right side of base. - Entry

- Stock drops below key support on volume while broader market go higher. (not good sign so Exit)

AVGO, SBX are growth stocks. MCD is yield stock.

Dividend Aristocrat stocks.- steady Grower (THOSE STOCKS ARE LISTED IN WIKIPEDIA under Dividend Aristocrat)

CTAS

Thank you for attending Trading Call Options in MetaStock 17 for Substantial Gains 01/29/20

Trader summit February 2020 - 2/17/20

Doji rule

Price will move inn the direction of how price opens after Doji

Top Ranked signals

- Your best friend -It is Doji (Doji followed by gap and Doji appear in oversold area of stochastic. )

- Left/Right combo

- Series of doji

- Candlestick signal followed by gap ups

- Kicker signal

- Bullish Flutter kicker

- Inverted Hammer

- Magnitude of signal

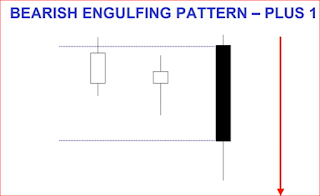

Bearish best friend.

Doji gaps down in over bought area.

Left/Right combo - left is Doji Right is Big candle stick, if it is white and appears in oversold area price go up. Left is doji and Right is red candle stick and it appears in overbought area and crossed T-line then it is bearish signal.

Bullish Doji sandwich - Bullish candle then Doji on top of that candle then Bullish candle on top of doji. Both candle looks same size and 2nd candle is above T-line. Expectation is more up side.

Prime trade select - Chuck Hughes

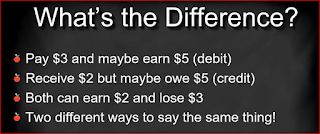

Purchase stocks or CALL on buy signal.

Purchase PUT or inverse ETF on sell signal.

Step-1

EMA Trend System Rules

A Stock is on EMA 'buy' signal when the 50-day EMA is above 100-day EMA

A Stock is on EMA 'sell' signal when the 50-day EMA is below 100-day EMA

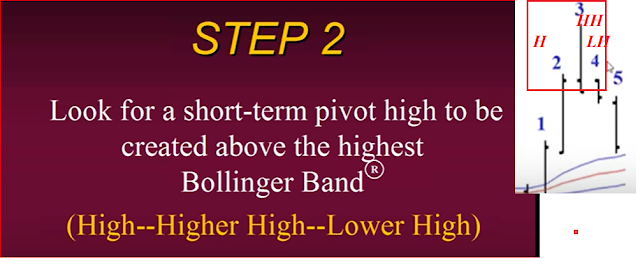

Step-2

use Keltner channel to find Lower risk entry points for stocks and options.

Stocks normally trade inside channel. when it goes above channel it is getting over bought and normally trades lower (circled)

Notice the Subsequent price declines when HD stock trades above upper channel.

When a stock trades below upper channel it is in a

Keltner "Buy Zone" and the stock or call option can be purchased.

Step-3

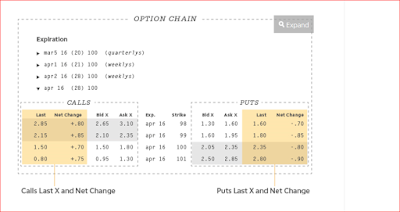

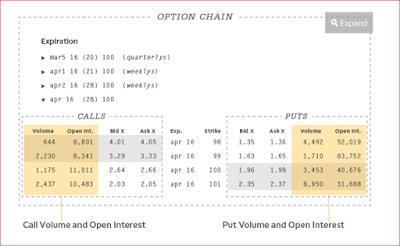

Use the '1% rule' to select an option strike price with higher percentage of winning trades

How do you determine which strike price to trade?

-Selecting a strike price can be just as important as the stock selection itself.

-Option premiums consist of time value and intrinsic value.

time + intrinsic = option premium

Each day before option expiration, the time value portion of an option decays.

The greatest amount of the time decay occurs in the last 30 days before option expiration.

Time value <1% of stock price.

The stock price needs to increase 1% in order for the opti0n trade to start profiting.

When you use 1% rule, the option intrinsic value willl increase 100 for each 1 point increase in the underlying stock.

for ex-

XLU current price 54.36

strike price 40

Intersic value = 14.36 (54.36-40)

time as per 1% rule = .54

Option premium = 14.80

Intersinc value = 14.36

so time value is .44 (14.80 - 14.36)

.44 is less than 1% of the 54.36 ( .54) stock price so this strike price qualifies under 1% rule.

in this example XLU only needs to increase .44 for the trade to break even and start profiting.

A 1% price increase to profit has a much higher probability of being profitable than an at-the-money or out-of-the money strike price that can require up to a 5 to 10% or greater price increase option expiration to profit.

Many times the expected stock price move will not occur before option expiration.

OPTIONSTRATEGISTdotCOM -McMILLIAN ANALYSIS CORP

Asia Online Traders Summit FEB 22-20

Online Traders Summit - March 21, 2020

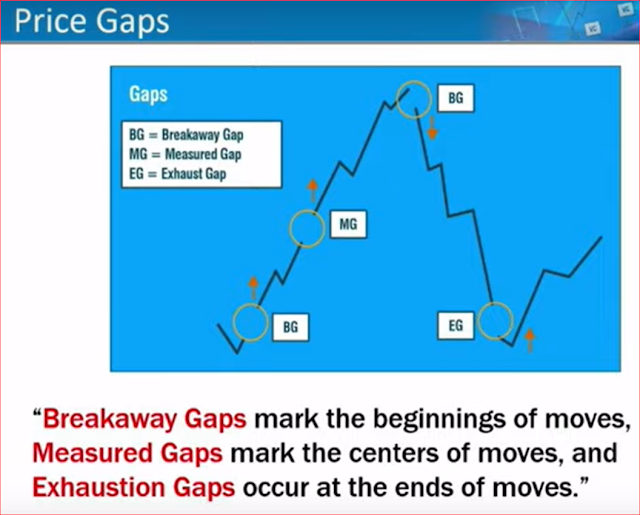

Strong breaks result in large moves