Go for CALL spread if trend is bearish.

- current price - strike = intrinsic value

- premium - intrinsic value = extrinsic value

- Options with intrinsic value are classified as in the money (ITM).

- If an option has a delta from .51 to 1.00, it’s in the money. If it has a delta of .50, it’s at the money. And if it has a delta of .00 to .49, it’s out of the money.

- Gamma grow larger as an option nears expiration.

- Buyers generally prefer options with smaller theta, while sellers generally prefer options with larger theta. Like gamma, theta tends to be largest in ATM options.

- If an option has a Vega of .01, the options premium will likely increase $0.01 with each 1 percentage point change in implied volatility.

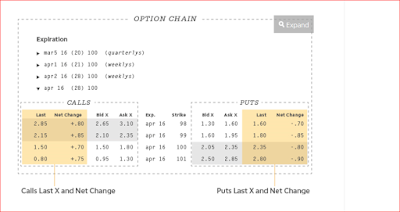

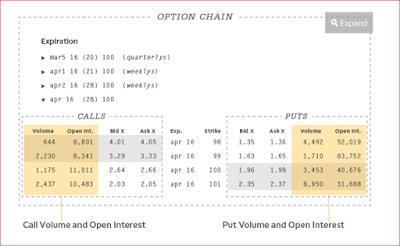

last and net change. Last refers to the last price—the amount at which the option last traded. Net change calculates the difference between today’s closing price and the previous trading day’s closing price. It’s a quick way to tell whether the option increased or decreased in value since the previous trading day.

For example, on the thinkorswim platform the bid and ask prices are the areas you’ll click to open a new order ticket and place a trade. If you’re buying a long call or long put, click the corresponding ask price. If you’re selling a short call or short put, click the corresponding bid price.

A good guideline is to only consider options with a bid/ask spread that is 10% or less of the ask price. To calculate this, subtract the bid price from the ask price, and then divide the answer by the ask price.

Bid - SELL

Ask - BUY

RULE OF 5 PROFIT SYSTEM - OPTIONS IT WORKS WELL FOR STOCKS TOO.

Trade in 3 minute time frame find W pattern for buy , M pattern for sell . I think we use bollinger band to find this and it's direction.

$5,000 Portfolio / 5 = $1,000 per Trade

if you get profit or loss, make it in portfolio again divide by 5 then trade. That is make the portfolio in compound. Compound is powerful tool than any other.

In this way you can make 5,000 in to 25,000 or more in one year.

Look at Discover the Exact Four Strategies for Making Consistent Investment Income - FEB 15, 2020 in Tiger trade 2020 or in options folder for video.

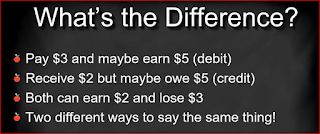

How to Decide Between Debit and Credit Spreads in Your Options Trading 02-27-20

WHAT IS VERTICAL SPREAD?

BUY ONE OPTION

SELL ANOTHER (SAME TYPE)

BOTH HAVE SAME EXPIRATION

BUY NOV$.50 CALL, SELL NOV$.55 CALL

50/55 VERTICAL SPREAD

DEBIT SPREAD --ASSET

CREDIT SPREAD -- LIABILITY

Buy 50/55 Call spread

Buy $50 call

Sell $55 call

This is Debit spread 50 Call cost more.

Right to buy for 50, Obligation to sell for 55. May earn $5 (difference in strike).

Buyer has an asset, Seller has an liability.,

Sell 50/55 Call spread

Buy $55 call

Sell $50 call

This is Credit spread

Right to buy for 55, Obligation to sell for 50. May owe $5 (difference in strike).

Selling a call spread is liability

Buy 50/55 Put spread

Buy $55 Put

Sell $50 Put

This is Debit spread .

Right to sell for 55, Obligation to buy for 50. May earn $5 (difference in strike).

Buying a Put spread is an asset.

Sell 50/55 Put spread

Buy $50 Put

Sell $55 Put

This is Credit spread .

Right to sell for 50, Obligation to buy for 55.

May earn $5 (difference in strike).

Selling a Put spread is an Liability.

This is intermediate trend trade (month or more)

We Buy ATM option with atleast month remaining.

Delta 0.55 Balances risk of longer holding period with a responsive option.

Wenty's Monthly Income 10000 for 600

Indicators PPO and ADX

Percent price oscillator (PPO) and MACD lare identical but calculations are different. PPO uses % MACD uses real price (dollor).

If PPO & ADX both lines is go each direction Buy option. Trade QQQ like highly liquidate options which end at 4.15PM QQQ is preferable by Windy.

If both lines are looks like meeting that is called P3 Squeeze so both lines go away from P3 Squeeze

Options for the following symbols trade an extra 15 minutes after the close of trading – DBA, DBB, DBC, DBO, DIA, EFA, EEM, GAZ, IWM, IWN, IWO, IWV, JJC, KBE, KRE, MDY, MLPN, MOO, NDX, OEF, OIL, QQQ, SLX, SPY, SVXY, UNG, UUP, UVXY, VIIX, VIXY, VXX, VXZ, XHB, XLB, XLE, XLF, XLI, XLK, XLP, XLU, XLV, XLY, XME, XRT.

VXX ETF reflect Volatility index VIX.

கருத்துகள் இல்லை:

கருத்துரையிடுக